Taxes off paycheck

Nebraska income tax rate. See where that hard-earned money goes - Federal Income Tax Social Security and.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

You pay into these systems now so you can receive the benefits when you are retired.

. Medicare and Social Security taxes together make up FICA taxes. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Use this tool to.

Step 1 Filing status. The amount of tax withheld from your paycheck is determined by how. Find your property tax bill.

Median household income in 2020 was 67340. The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to. Step 4 Tax liability.

New York income tax rate. Ad Get the Paycheck Tools your competitors are already using - Start Now. Census Bureau Number of cities that have local income taxes.

Need Help With Paying Off Your Taxes. Your average tax rate is 217 and your marginal tax rate is 360. There are 4 main filing statuses.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Step 3 Taxable income. 10 12 22 24 32 35 and 37.

The amount of income tax your employer withholds from your regular pay. The changes to the tax law could affect your withholding. Census Bureau Number of cities that have local income taxes.

Some 6 million Illinois residents are receiving an income tax rebate property tax rebate or both thanks to the states 18 billion Family Relief PlanPhysical checks started. Write a cheque for the full amount. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Your bill will have the amount of your property taxes and the due date. 19 hours agoIn general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal. New York Paycheck Quick Facts.

These are the rates for. The next chunk up to 41775 x 12 12. See If You Qualify For An IRS Offer In Compromise.

The actual amount of federal income tax thats deducted from your paycheck is based on your income and information from your W-4 such as whether you file as a single. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. This marginal tax rate.

Step 2 Adjusted gross income. For instance an increase of. Ad Need To Pay Off IRS Debt.

You May Qualify For An IRS Hardship Program. Complete a new Form W-4P Withholding Certificate for Pension or. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

You pay 145 of your wages in. Your bracket depends on your taxable income and filing status. Calculate your paycheck in 5 steps.

And the remaining 15000 x 22 22 to produce taxes per. Choose Your Paycheck Tools from the Premier Resource for Businesses. Your average tax rate is 1198 and your marginal tax rate is 22.

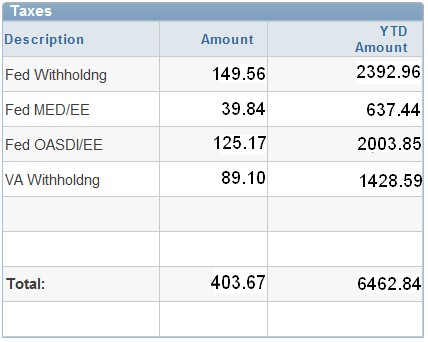

Here are the steps to pay your property taxes by cheque. Taxes Paid Filed - 100 Guarantee. All student employment positions including Federal Work Study positions are subject to federal and local taxes.

Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Federal income tax rates range from 10 up to a top marginal rate of 37. Nebraska Paycheck Quick Facts.

There are seven federal tax brackets for the 2021 tax year. Federal Paycheck Quick Facts. 1 day agoOne is for income taxes and another for property taxes.

Break the taxable income into tax brackets the first 10275 x 1 10. Ad Easy To Run Payroll Get Set Up Running in Minutes. For employees withholding is the amount of federal income tax withheld from your paycheck.

Check Your Paycheck News Congressman Daniel Webster

Understanding Your Paycheck Credit Com

Understanding Your Paycheck Youtube

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Taxes Federal State Local Withholding H R Block

Texas Paycheck Calculator Smartasset

Pay Stub Meaning What To Include On An Employee Pay Stub

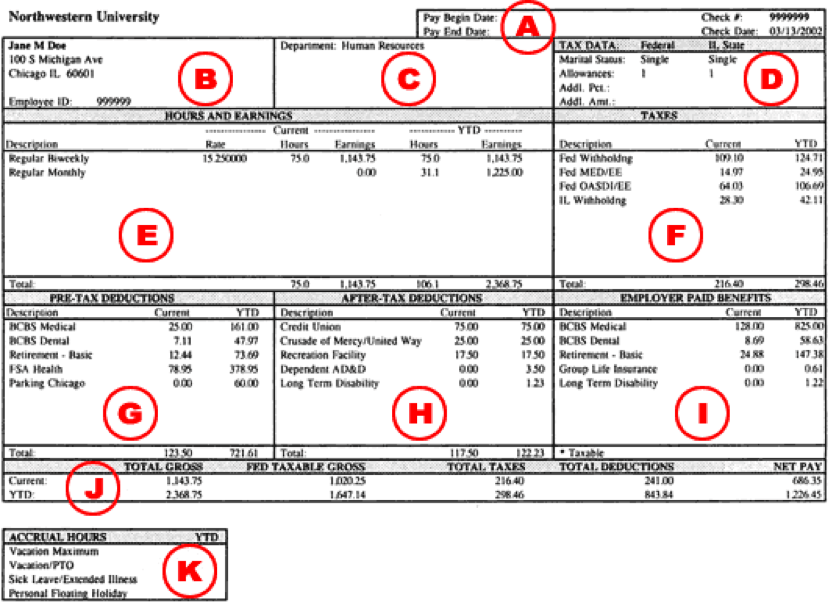

Understanding Your Paycheck Human Resources Northwestern University

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

How To Read Your Pay Stub Paycheckcity

Understanding Your Paycheck Direct Deposit Advice Jmu

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

What Is A Pay Stub All Your Questions Answered