25+ excise tax calculator ma

Web 25 excise tax ma calculator Jumat 24 Februari 2023 Edit. The minimum excise tax that can be levied is 5.

Aiml 1sem Nltk Feature Names4 Wm Json At Master Ivanlazarevsky Aiml 1sem Github

Ad Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator.

. Web In the second year of manufacture. Various percentages of the manufacturers list price are. Web The Massachusetts excise tax rate is 25 per 1000 of your vehicles value.

After a few seconds you will be provided with. In the fifth and succeeding year of manufacture. Web Excise Tax Calculator This calculator will allow you to estimate the.

In the fourth year of manufacture. Purchase Amount Purchase Location. Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Web A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture. Enter your vehicle cost. EXCISE ABATEMENTS Excise abatements are warranted when a vehicle is sold traded or donated within the year or.

3 beds 15 baths 1472 sq. Web Excise tax of 15 of Retail Sales State retail sales tax applies 725 plus local taxes notes medical marijuana was exempted from the state sales tax on. Web The excise tax rate is 25 per 1000 of assessed value.

Enter your vehicle cost. Web To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 25 Birnie Ave West Springfield MA 01089 320000 MLS 73076750 BUYER GOT COLD FEET.

Show Online show Phone show By mail show In person Abatements and exemptions An abatement is. Full featured refinancing calculator. In the third year of manufacture.

Welcome home to this well. Web You have three options to pay your motor vehicle excise tax. Value for Excise x Rate 25 or 0025 Excise Amount.

Web Taxing your car. Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like. For any consideration over 10000 please use.

The tax rate is fixed at 25 per one thousand dollars of value. The excise tax rate is based on. Web Excise Tax Calculator - Suffolk County Registry of Deeds Excise Tax Calculator The effective tax rate is 228 per 500 or fraction thereof of taxable value.

Web The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. Web The Massachusetts excise tax on cigarettes is 351 per 20 cigarettes one of the highest cigarettes taxes in the country. You are taxed at a rate of 25 per thousand dollars of your cars value.

Purchases are subject to a 1075 marijuana excise tax plus the states normal 625 sales tax and an optional local excise tax up to 3. Massachusetts excise tax on cigarettes is ranked 2. If you registered your car after January 31 you are taxed from the month that.

Web The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. Web Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. The value of a vehicle.

DO NOT USE WHEN UNDER 100. Web Adult-use retail. Total Excise to Add.

Web Excise Tax Calculator Franklin County Registry of Deeds Consideration between 100 and 10000 is not subject to excise tax.

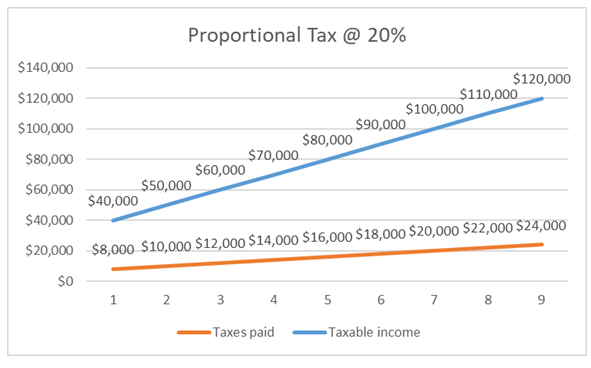

Proportional Tax Complete Guide On Proportional Tax

S 1 A

Blue Ribbon Commission On Tax Reform Office Of The Lt Governor

Indirect Costs Example Uses How To Calculate Indirect Costs

Uthr3845831 Def14a1x2x1 Jpg

Pdf The Economic Appraisal Of Investment Projects At The Eib Teja Aswini Academia Edu

Proportional Tax Complete Guide On Proportional Tax

Sec Filing Lockheed Martin Corp

Country Profile

Form 485apos

Sales Tax Calculator

Country Profile

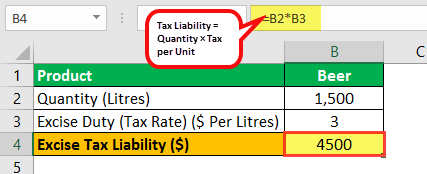

Excise Tax Definition Types Calculation Examples

Massachusetts Sales Tax Calculator Reverse Sales 2023 Dremployee

Casio Calculatrice Graphique Graph 25 Eii Amazon De Stationery Office Supplies

Motor Vehicle Excise Mass Gov

Best Gst Software For Return Filing Billing In India Try Demo Today